rhode island state tax withholding

While some mandatory states may have some special exceptions to withholding Betterment does not currently support. Nonresident organizations holding IRC 501c status but which have unrelated business income tax due for this transaction are subject to the provisions of RI.

However the associated withholding and the payment would be reported on the second quarter RI.

. 2023 2022 2021 2020. The Governors Workforce Board assists Rhode Island employers by funding a variety of projects designed to improve and upgrade the skills of the existing workforce. Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount.

Select Tax filing type. Rhode Island Taxable Income Rate. Start filing your tax return now.

Withholding Formula Rhode Island Effective 2021 Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages. TAX DAY NOW MAY 17th - There are -361 days left until taxes are due. If filing is the first andor the second month of the quarter a T-204M-R reconciliation must be comple ted.

Withholding Tax Weekly Return. UI customers have the option of withholding Federal andor State income tax from their UI benefits. A Rhode Island resident individual works for an employer in State B normally performs his or her tasks within.

Additionally employers in other states may wish to withhold Rhode Island personal income tax. Employers pay an assessment of 021 to support the Rhode Island Governors Workforce Board as well as employment services and unemployment insurance activities. The table below shows the income tax rates in Rhode Island for all filing statuses.

The Rhode Island withholding law requires employers in the. In Rhode Island income from nonresident employees who normally work there but are temporarily working somewhere else is still subject to its state income taxes. The Division will not require employers located outside of Rhode Island to withhold Rhode Island state income tax from the wages of Rhode Island resident employees who are temporarily working within the state solely due to the COVID-19 state of emergency.

General Tax Filing Instructions. If you dont file a certificate of withholding based on your gain it will be 6 of the total sale of your property minus the cost of sale. The associated withholding would be reported on the quarter ending 03312020 RI-941 as well as the payment.

A resident is defined as anyone who is domiciled in the state or who spends 183 days of a tax year in the. But a Rhode Island resident who normally works across state lines but is temporarily telecommuting from Rhode Island does not need Ocean State taxes withheld during the pandemic. The income tax wage table has changed.

Any part of the wages were for services performed in Rhode Island. Withhold 62 of each employees taxable wages up until they reach total earnings of 147000 for 2022. State Tax will be withheld at the rate of 25 of your gross weekly UI benefit amount.

When its filed your payment is recorded and your lien is released. In accordance with Rhode Island law UI is taxable income. As an employer you will also need to pay this tax by matching your employees tax liability dollar-for-dollar.

Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount. Please use Microsoft Edge browser to get the best results when downloading a form. To have forms mailed to you please call 4015748970.

Rhode Island ID number. The Rhode Island tax liability before any withholding or credits is 800 and his tax liability to State X before. Withholding tax forms now contain a 1D barcode.

How much is the tax. States that have mandatory state tax withholding on distributions include. Daily quarter-monthly monthly quarterly and annually.

January February March April May June July August September October November December. No action on the part of the employee or the personnel office is necessary. The Rhode Island withholding law requires employers in the state to withhold Rhode Island income tax from wages of residents for performing services both inside and outside the state and of nonresidents for service performed within the state.

1 - 7 8 - 14 15 - 21 22 - 31. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Any payroll from April 1st April 4th would also be due on Monday April 6th.

The buyers attorney will file a certificate of payment with the Rhode Island Division of Taxation. Arkansas California Connecticut Delaware Iowa Kansas Maine Massachusetts Michigan North Carolina OklahomaOregon Vermont Washington DC. The income tax withholding for the State of Rhode Island includes the following changes.

11-digit number Filing for tax year. Detailed Rhode Island state income tax rates and brackets are available on this page. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if.

Your payment schedule ultimately will depend on the average amount you hold from employee wages over time. Enter the employers state ID number and password. Tax-exempt organization means the seller is exempt from taxation by Rhode Island charter or by specific authorization as a tax-exempt organization under Internal Revenue Code section 501c.

Federal Tax is withheld at the rate of 10 from your gross weekly UI benefit amount. The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates. Any earnings above 147000 are exempt from Social Security Tax.

The annualized wage threshold where the annual exemption amount is eliminated has changed from 231500 to 234750. An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding. Paper forms make use of scanlines to aid in processing.

In Rhode Island there are five possible payment schedules for withholding taxes. The annualized wage threshold where the annual exemption amount is eliminated has increased from 227050 to 231500. All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format.

File Scheduled Withholding Tax Payments and Returns. Social Security Tax. Withholding Formula Rhode Island Effective 2022.

Input payment amount and authorize EFT. A the employees wages are subject to Federal income tax withholding and b any part of the wages were for services performed in Rhode Island 280-RICR-20-55-106C1. Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages.

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

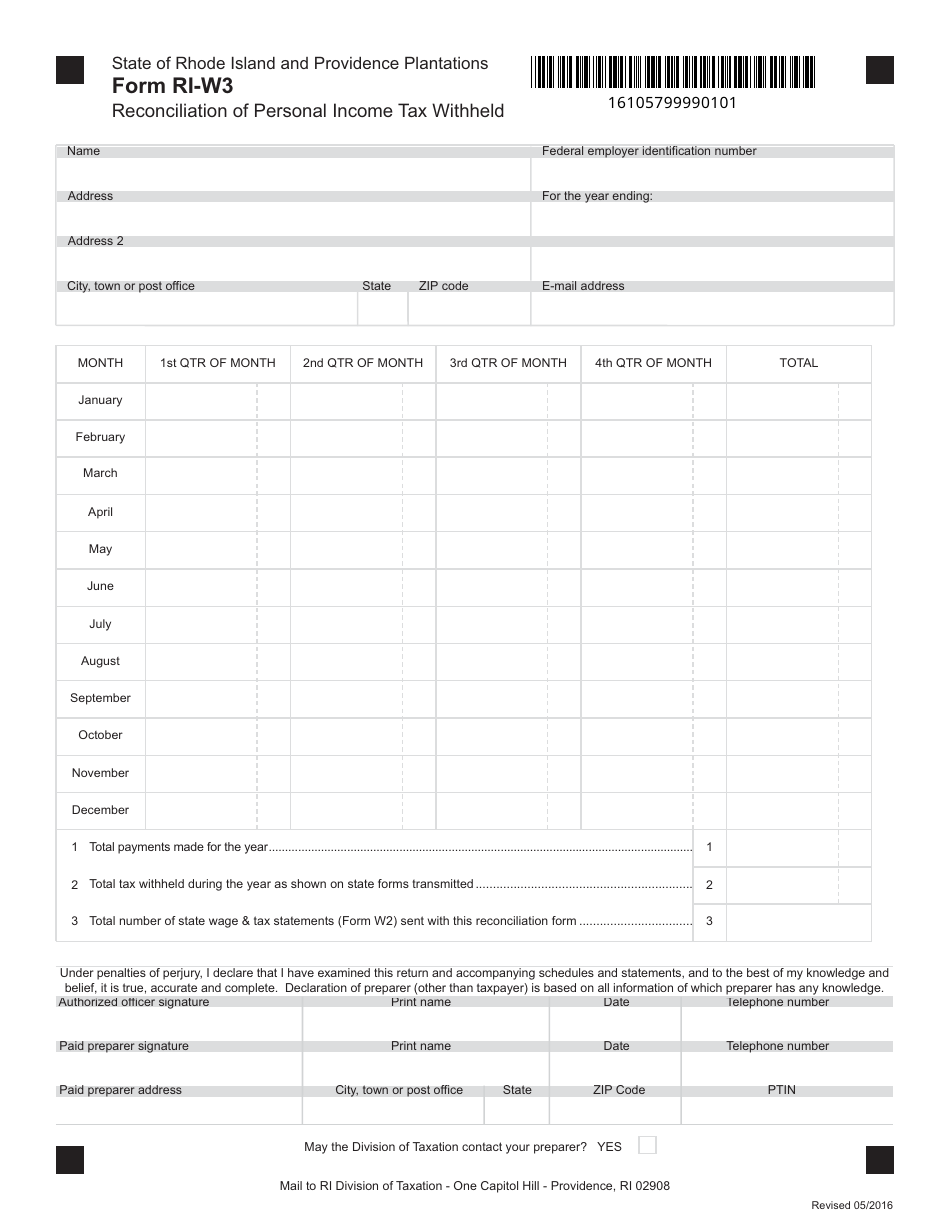

Form Ri W3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller

State Of Rhode Island Division Of Taxation Division Rhode Island Government

Tax Withholding For Pensions And Social Security Sensible Money

State Of Rhode Island Division Of Taxation Division Rhode Island Government

Form It 2104 New York State Tax Withholding South Colonie

Withholding Allowances Payroll Exemptions And More

Irs Form 945 How To Fill Out Irs Form 945 Gusto

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

2020 W 4 Form Example Filled Out

State W 4 Form Detailed Withholding Forms By State Chart

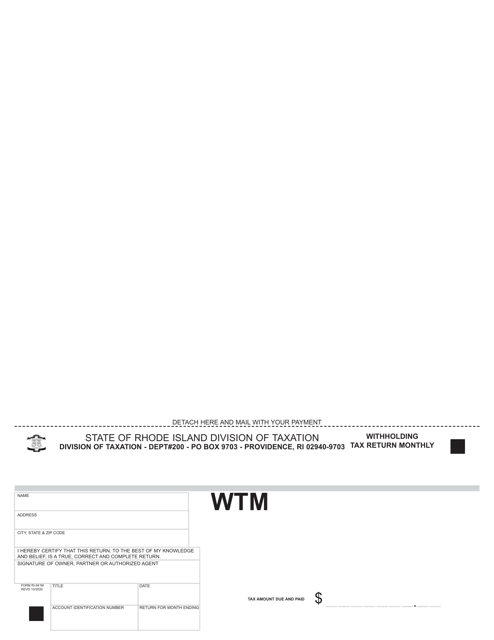

Form Ri 941m Download Fillable Pdf Or Fill Online Withholding Tax Return Rhode Island Templateroller